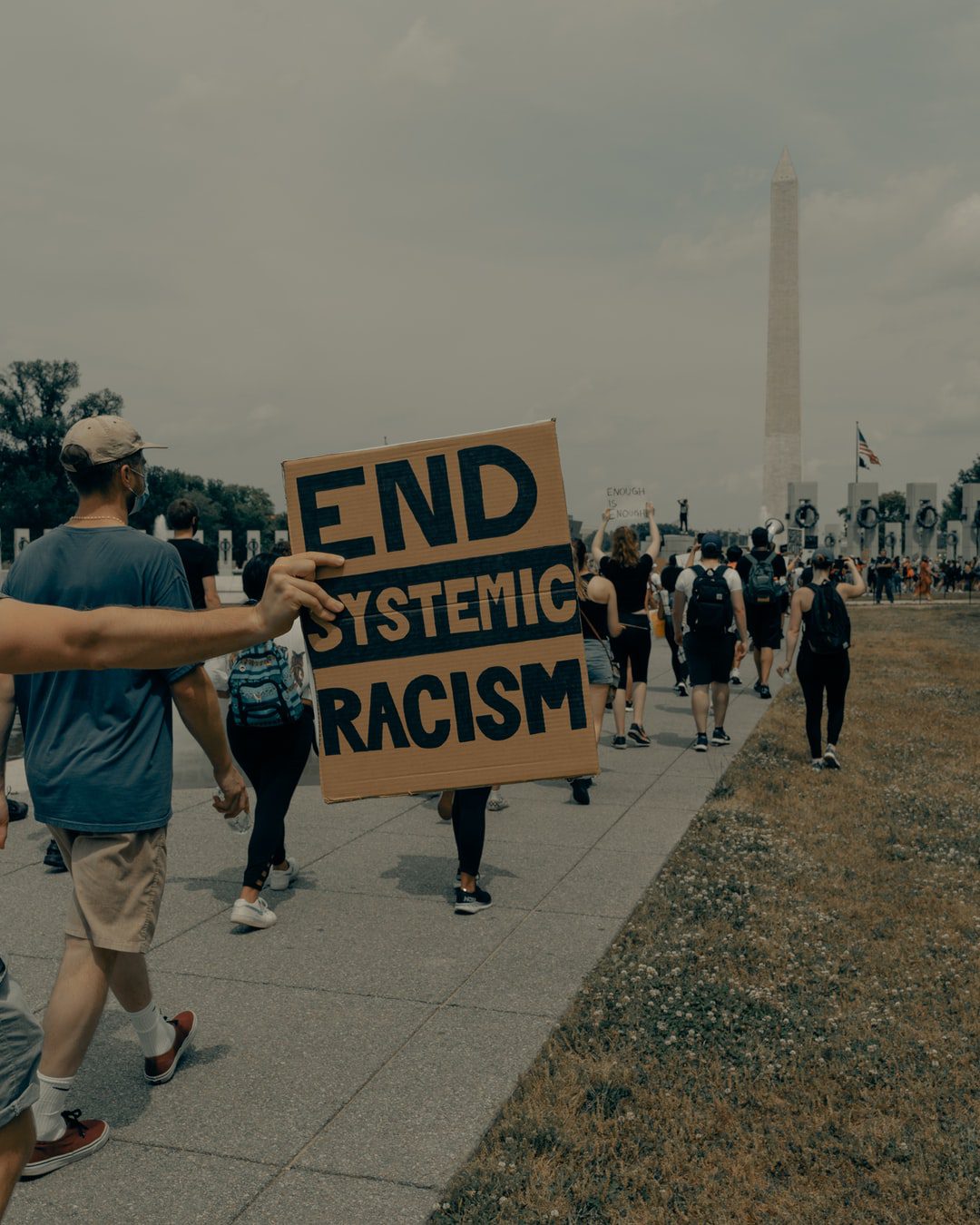

According to Vox, systemic racism is a real issue in America. In an article that goes quite in-depth, they cover how Black people have less confidence in the police, feel that the federal government is doing less for them, and they also face higher hospitalization rates.

If you work in the insurance industry, then you might be worried about how systemic racism in the insurance market occurs. How bad is it, and what can you do to avoid engaging in discrimination yourself?

Not knowing the answer to this can be stressful. Fortunately, in this article, we’ll review what you need to know about systemic racism in the insurance sector and what you can do to avoid doing it.

Finally, you can fight systemic racism while providing insurance fairly. Read on to learn more.

The State Farm Discrimination Situation

The following story we cover in this section is from The New York Times article, "Where State Farm Sees 'a Lot of Fraud,' Black Customers See Discrimination," written by Emily Flitter and published on March 18, 2022.

Darryl Williams, a man who built up a realty business in Chicago over a large number of years, found himself experiencing insurance discrimination in 2017. In that year, one of his most important properties, which contained six apartments, had a pipe that burst.

To deal with this problem, he contacted State Farm, his insurer. He was hoping that they would help with repairing the damage.

Instead, the claims adjuster at State Farm said she didn’t believe what he’d told her. She explained that there was a large amount of fraud within his neighborhood.

This was a primarily Black neighborhood.

Eventually, State Farm paid for a small amount of the claim. By the time this happened, Williams’ expenses had snowballed. He’d had to sell buildings to pay off bills.

Of course, many insurers have a strong incentive to pay as small an amount as possible in customer claims. This is a big part of what makes their business model work for them.

However, Williams felt that there was more going on here. He thought that what had happened was because of racism. To him, racism was the explanation for State Farm’s poor treatment of him.

The Decision to Sue

He decided to sue State Farm for discrimination. He wanted this to be a class-action lawsuit. However, the judge felt that he would not be able to create a class-action lawsuit due to an analysis of claims data in the state of Illinois not being enough to justify one.

But after this occurred, Carla Campbell-Jackson got involved with this insurance discrimination situation.

Campbell-Jackson, a Black woman, used to work for State Farm in Illinois and Michigan for 28 years.

In 2016, State Farm fired her. The grounds they gave for this were that she’d shared information that was confidential outside the company. She denied this claim.

She said that State Farm firing her was the last move the company had made to discredit her.

This was after she had raised concerns about State Farm using fraud in the form of a pretext so they could deny Black customers’ insurance claims.

In 2021, the Equal Employment Opportunity Commission said that State Farm had, in fact, discriminated against Campbell-Jackson.

Additionally, she’s sued the insurance company with an accusation of retaliation and discrimination.

When she found out about Williams’ lawsuit, she decided to testify on his behalf. Williams hopes that her testimony will strengthen his class certification request.

He hopes this will occur due to the fact that there will also now be inside information regarding how State Farm treats its Black customers.

Other Cases of Racial Discrimination Related to State Farm

There are dozens of agents of color, customers, and employees who are accusing the State Farm insurance company of racial discrimination. It has been occurring in the workplace and it has also been impacting customers when they file claims.

In terms of employees and agents, they have received anonymous letters with racist language. Some minorities were expected to work in areas where more minorities lived.

According to Campbell-Jackson, State Farm encouraged agents to deny more claims from people living in neighborhoods where fraud was more common. These were often inner-city neighborhoods.

In her eyes, this was just an easy way to deny payments—millions of dollars of them—to African American policyholders (as well as other minority policyholders).

What You Can Do Fight Systemic Racism in the Insurance Sector

Given how rife discrimination is in the insurance market, you likely want to know how you can fight systemic racism. This includes watching out for discrimination and bias when using algorithmic models and big data, being aware of how you approach health insurance, and more.

Using Algorithmic Models and Big Data Carefully

When, as an insurer, you’re using algorithmic models and big data, this is something that should make running your business easier. However, the problem with these types of technologies is that they often cause discrimination and bias that are unintentional.

Datasets often don’t have any regulation going on, so you might be creating some processes in your insurance company that are based on information that isn’t studied enough.

The best solution is for legislators to pass laws that make it possible for people to see what the data, as well as resulting algorithms, actually look like.

In the meantime, you should approach using these methods with caution. Be aware of what biases you might be accidentally putting into place as a result.

Using the Right Approach Regarding Health Insurance

Because health insurance discrimination related to longer waiting periods, discriminatory pricing, and preexisting conditions is now illegal, there is another issue occurring now in the health insurance industry. Health insurance companies now discriminate with a specific type of practice.

This practice is, more or less, charging more for specific conditions that are prevalent among some groups more than others.

This prevents patients from getting medical care that is appropriate. Often, these patients are members of minority groups and have health issues that are complex.

Another problem that can occur is when medication for illnesses that are more common among minorities end up on the highest of the formulary tiers.

Additionally, there’s a problem going on in urban areas that have a high population of minorities. In these areas, many physicians receive insurance reimbursement rates from private companies that are lower.

As a result, these areas have fewer physicians in them. This makes access to medical care more challenging.

The Solution: Addressing Health Equity

The solution to this problem is addressing health equity. To do this, we recommend that you tailor the care you provide to every minority group. This way, you can know what their needs are when you’re putting together the different insurance plans you offer.

Increasing Diversity Within the Insurance Sector

Another way to combat systemic racism is by increasing diversity within the insurance sector itself. To do this within your own insurance company, there are several strategies you can use. These include making a business imperative, creating a talent pipeline, and using data and accountability.

Making a Business Imperative

It’s smart to make your decision to battle systemic racism a business imperative. This way, you can ensure that this is something you aim to do with your business. You can start setting up goals to increase the number of minorities or people in your company who are usually underrepresented in your industry.

Creating a Talent Pipeline

By creating a talent pipeline, you can ensure that you diversify your staffing efforts. This way, you’ll have diverse employees who are talented and who will become tomorrow’s leaders. Over time, this will help you increase diversity and avoid systemic racism.

Using Data and Accountability

It’s also important that you have data available regarding your efforts to combat systemic racism. This way, you can find out what’s working and what isn’t. You can hold yourself accountable for your efforts, making your decision to fight racism effective.

Want to Learn More About Battling Systemic Racism?

Now that you’ve learned about systemic racism in the insurance sector, you might want to learn more about how to battle it. Maybe you want to learn how you can combat it in a different industry or how to deal with it if you’ve been facing it in the workplace.

Whatever information you need, we can help. At GLP Personal Injury Attorneys, we serve clients, healthcare providers, attorneys, and communities throughout the Pacific Northwest with compassion for all. We have been pursuing justice for the wrongfully injured for over 36 years and stand ready to serve you.

If you need us to help you with your personal injury legal needs, contact us now.